WYND DAO Overview/Documentation - By WYND DAO Team

A DAO focused on DeFi/ReFi in the Cosmos ecosystem built on the Juno Blockchain.

This originating information accuracy is in no way endorsed by Curious Cosmonaut Research. This paper’s content was aggregated from their website here on 1/12/2023 as part of a series to make content more accessible from one place in Cosmos.

Welcome to WYND DAO

WYND DAO is an innovative, multi-protocol DAO that harvests the best of DeFi to fund positive real-world environmental impact.

It is based upon the WYND Token, which was launched on Juno in late May 2022 in a Community Fairdrop. This has a long vesting curve that slowly becomes liquid between Sep 1, 2022, and Sep 1, 2023.

On top of this, we build an [innovative governance model to provide intelligent guidance to this living system. This is based on the wonderful work of DAO DAO, along with a custom staking and reward module of our design.

The DAO will come live on Sep 27, 2022. At that point, staking will be possible, to earn rewards and, most importantly, participate in governance votes to guide the protocol.

This DAO shall launch multiple, sustainable DeFi protocols on Juno and beyond. Staking derivatives are currently under construction, but many more will also be coming shortly, guided by the decisions of the WYND DAO.

Notably, these protocols will not run only on Juno, but over multiple blockchains, that support CosmWasm. All protocols will have the same governance contract, the WYND DAO on Juno, which can adjust the protocols on multiple chains. This WYND DAO will also receive the revenue from the various protocols it deploys, on Juno as well as on other IBC-enabled chains.

Speaking of revenue, this is where the DeFi aspects come in. The revenue from the various protocols doesn’t all go to the WYND DAO. Instead, it is collected in a “revenue sharing” contract, which sends 75% to the WYND DAO Treasury, and 25% to a special sub-DAO that manages environmental grants.

There will be an environmental sub-DAO appointed by the main WYND DAO, whose job is to find valid projects to support, evaluate their potential, and distribute this portion of the rewards to innovative, high-impact environmental projects. The WYND DAO will provide high-level guidance on the types of initiatives to focus on, but the committee will be empowered to review and select the particular projects of interest.

All together, you see how WYND DAO is the center of a growing web of interconnected protocols, funneling revenue to good causes. “Make money while helping the planet”. Truly a win-win for all involved.

Browse the documentation to learn more, dig into our Medium blog, or follow us on Twitter for the latest news.

Disclaimer: Nothing herein constitutes legal, financial, business, or tax advice, and you should consult with your own legal, financial, tax, or other professional advisors before engaging in any activity in connection herewith. Neither the WYND Foundation nor any of the team members who have worked on the WYND protocol, nor any Service Provider shall be liable for any direct or indirect damage or loss whatsoever that you may suffer in connection with accessing the whitepaper, the website at https://docs.wynddao.com or any other websites or materials published by the company.

$WYND Token

The foundational layer of the project is the $WYND token, which is minted by the protocol. This token will serve as a governance token for the WYND DAO.

While designing the tokenomics, we spent time making this token sustainable, both environmentally and financially. We do not want to repeat the mistakes of Klima DAO, which tried to contribute to the environment while replicating Olympus DAO’s Ponzi-omics. (Look at one-year graphs to see what we mean).

Instead, we would “slowly” grow 3x over one year, better than make a 100x to lose it all in the following two months. We feel OSMO and JUNO are better models of a growth curve to aim for.

We accomplish this by providing real value to the WYND DAO (governance backed by real projects, which drive long-term value) and slowly increasing the liquidity via vesting rather than a massive dump of liquid tokens. We also feel that 3-digit APRs are inherently unsustainable, and the WYND DAO will focus on longer-term incentives for HODLers, not for yield farmers.

Token Distribution

WYND belongs to the people, not to wealthy VC firms. That is why we have decided not to do any private sales or investment rounds and rather self-fund the project to launch. We will make a fair distribution of all genesis $WYND tokens without any remuneration in return.

At genesis, there will be 108 million $WYND tokens.

Of these tokens, we will distribute them as follows:

- 20% WYND Foundation

- 15% Development Team

- 65% Airdrop

Yes, almost two-thirds of the total token supply will be fair-dropped on active Cosmos citizens! We have also worked hard on a design that is difficult to game and fairly distributed among actual citizens and look forward to encouraging a vibrant and active community around the WYND DAO.

The WYND Foundation is a registered BVI Entity and will be issuing these tokens. It will give 20% of the supply to itself to help guide and fund the WYND DAO in the first months and years. These funds will be used to ensure sufficient liquidity of the $WYND token, fund development projects like the Oracle service, and fund other actions for the good of the community.

The development team fund will reward those who put in the energy to bring this to launch but will also leave some funds in reserve, controlled by the WYND Foundation, to reward significant contributors who join the DAO after launch.

Please note that most of these tokens will be subject to a vesting period to limit initial liquidity and avoid quick dumping. The foundation will have around 25% of their token supply liquid on day one, so they can help establish the LP pools. But all the rest of the genesis tokens will be vested on various schedules.

Future Minting

Many protocols mint more tokens over time to be able to pay for ongoing development, and marketing or to provide incentives to LPs or stakers. However, there need to be clear limits to the growth of the token supply, and ideally, the inflation rate should decrease over time. We have decided to allow a maximum minting of 42 million $WYND per year. Note that this implies a reduced percentage every year as the supply increases.

The minting will be controlled by a vote of the WYND Community DAO, and the actual tokens minted may well be less than this maximum. These numbers define the limits to minting hardcoded in the $WYND token contract.

We also don’t prescribe where the tokens go but let the DAO decide on the distribution of these tokens based on the future needs of the chain. “Do we need more marketing or dev?” “Do we want to mint fewer this year with the potential to use them next year?” Based on the changing market and environment, this is up to the DAO to decide.

To have a final supply cap, we will limit minting to 42 million per year for the first eight years and 37 million $WYND per year for the following 12 years. After 20 years, minting $WYND will be halted, leaving a permanent hard-cap of 888 million $WYND tokens.

You can view the increase in supply in this table.

| year | total supply | supply increase |

|---|---|---|

| 1 | 150 M | 38.888 % |

| 2 | 192 M | 28.000 % |

| 3 | 234 M | 21.875 % |

| 4 | 276 M | 17.949 % |

| 5 | 318 M | 15.217 % |

| 6 | 360 M | 13.208 % |

| 7 | 402 M | 11.667 % |

| 8 | 444 M | 10.448 % |

$WYND Fairdrop

We have seen the drama on some chains when dealing with the consequences of gamed airdrops. We did not release any details of how the calculation was performed until after the snapshot.

We are doing our best to make this distribution “fair”. Not just by releasing 65% of the tokens to the general public but also in how we select the participants. We will seek to exclude any accounts tied to centralized exchanges and only grant to people who possess their tokens.

Goals of Airdrop

Cosmos has many chains and many active contributors in many different forms. We wish to invite as many of them as possible to participate in the birth of the WYND DAO. We have looked at many other airdrops and are doing our best to learn from their successes and failures. One notable item is to avoid people looking to “game the system” and quickly dump any airdropped tokens. For this reason, all airdropped tokens will be vesting, meaning that they can be used for voting and staking from day one, but it will take a full year until they can all be freely transferred and sold.

Recipients

We will be rewarding both Stakers and Validators of Juno, Osmosis, and Regen.

Juno is the major CosmWasm chain currently and where we will launch WYND. It also has a growing ecosystem of developers we would like to collaborate with.

Osmosis is the central Dex of the Cosmos ecosystem and has fantastic community discussions. We want to bring some of that spirit of discussion to the WYND DAO.

Regen is the OG ReFi project in Cosmos, and perhaps all of the blockchain, working on issuing verifiable, high-quality Carbon and Biodiversity credits. We have much alignment with their philosophy and wish to invite their community of believers to form a core part of the new WYND DAO.

Even though we provide slightly smaller allocations to Regen, it has about 20% of the market cap and 5% of the number of stakers as Juno, making the allocations to each Regen staker the highest.

We will reserve some airdrop tokens to perform a second round to lend a hand to those hardest hit by the LUNA implosion, which will occur when technically possible. Minimally, it will include bonded LP holders in the Osmosis UST and LUNA pools around May 9th, who were wiped out as the market crashed and unable to move their tokens. We will also attempt to provide some to those who had staked LUNA on the Terra network, but this is more complex as the signing tools, and address derivations on Terra and Juno are different.

Distribution Details

5% of the total token supply, or 5.4 million $WYND, will be airdropped to various validators. As there are many fewer validators than stakers, they should still receive significantly more than the average staker in light of the hard work they perform and their central role in the ecosystem. This will be split as follows:

- 2 million $WYND for Juno validators

- 2 million $WYND for Osmosis validators

- 1.4 million $WYND for Regen validators

Of the remaining 60% of the tokens reserved for the airdrop, or 64.8 million $WYND, we will distribute this as follows:

- 35%, or 22.7 million $WYND, will be split by Juno Stakers

- 10%, or 6.5 million $WYND, will be split by Regen Stakers

- 25%, or 16.2 million $WYND, will be split by Osmosis Stakers

- 30%, or 19.4 million $WYND, will be reserved for the second round

The second round will take place when technically feasible to perform all needed calculations, most likely in June. At a minimum, this will reward people who had 7 or 14 day bonded LP positions on the following Osmosis pools before the Terra meltdown: LUNA/UST, LUNA/ATOM, LUNA/OSMO, OSMO/UST.

If technically possible, we will also drop some $WYND on $LUNA stakers from the Terra network, although the claim is a bit more tricky as the wallets are not interoperable with Juno.

Timing

We took snapshots of Osmosis and Regen on May 5, 2022. We took the Juno snapshot from May 6, right after the Unity upgrade. We chose this date to reward the stakers who genuinely believe and didn’t start dumping in April as the bear market hit.

We have performed complex calculations on the distributions in order to find a smooth distribution that rewarded average holders, not whales, and not people trying to game the system with lots of “dust accounts”.

The airdrop will go live on June 6 and remain live until August 31, 2022. Any tokens not claimed by the end of the airdrop will be “clawed back” and sent to the WYND DAO community pool, which will be live by then. Those clawback tokens will have the same vesting period as all the airdrop recipients.

Multichain Claims

You will need to provide your Juno address to view your portion and claim it, but we will match accounts on other chains to the corresponding Juno address and perform the airdrop on one chain. This also means you will need a 0.001 $JUNO or so to pay gas fees, which should easily be able to get on Osmosis.

The address format and derivation on Juno, Osmosis, and Regen are the same, so it is pretty easy to convert accounts from one chain to another while ensuring the private key holder has access to the new account.

If you have your private keys in Keplr or a Ledger, generating the Juno address should be no problem. If your keys are stored in a local binary (say gaiad), you should be able to port them to another binary (junod), and we hope to provide a document on how to do this for the typical case. In the worst case, you can import them in Keplr or a Ledger if you have the mnemonic.

If a custodial solution holds your keys, you may be out of luck and must discuss it with the custodian. And if you manage your keys with a unique solution, we cannot provide support except to show how to import your mnemonic into another solution.

Vesting Plans

As the WYND project seeks to encourage sustainability and long-term commitment, we will be using vesting plans on almost all the genesis tokens (except for a small amount of liquidity immediately available by the Foundation to bootstrap the AMM Pools). This design is based on the standard Cosmos SDK vesting account, but we implemented this as part of a cw20 contract, as the above only works with native tokens.

Tokens that are vesting will only be able to be used with the DAO staking contract to get voting rights. All other tokens in the account (including liquid tokens sent to the account later) will be able to be used normally.

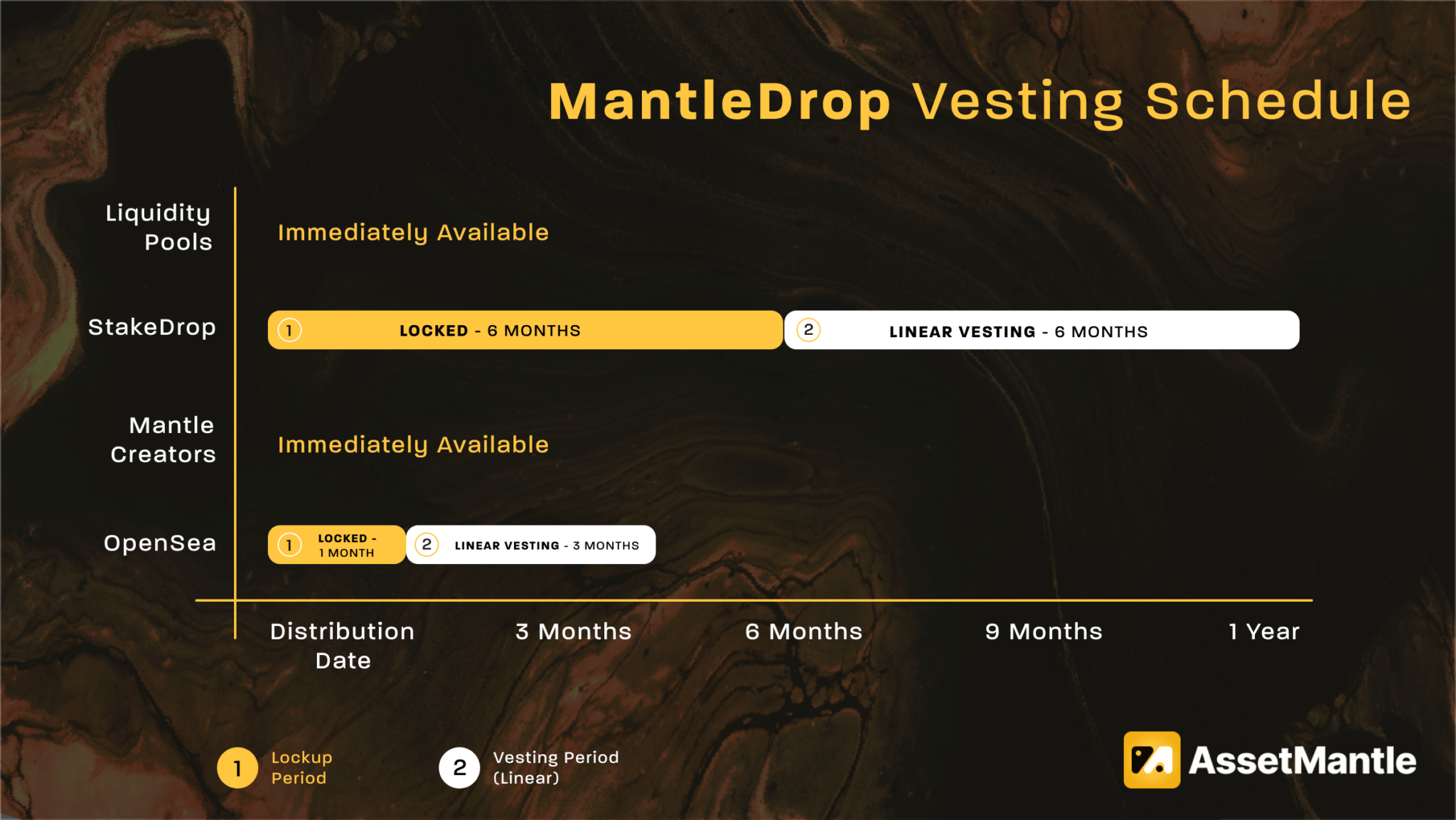

While researching this design, we discovered that we are not the only project to provide vesting on the airdrops, and Asset Mantle is using a similar approach:

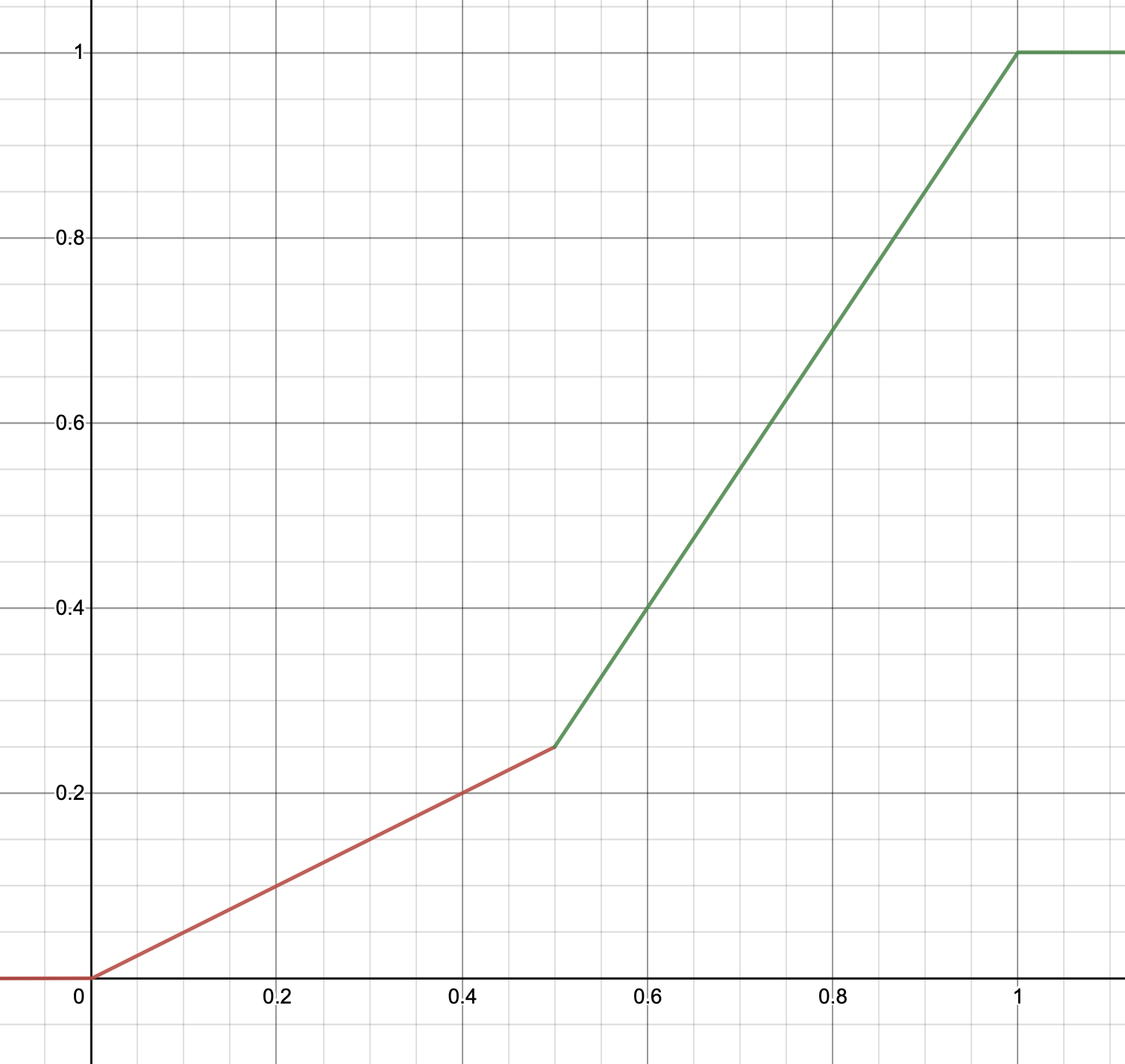

Curves Used

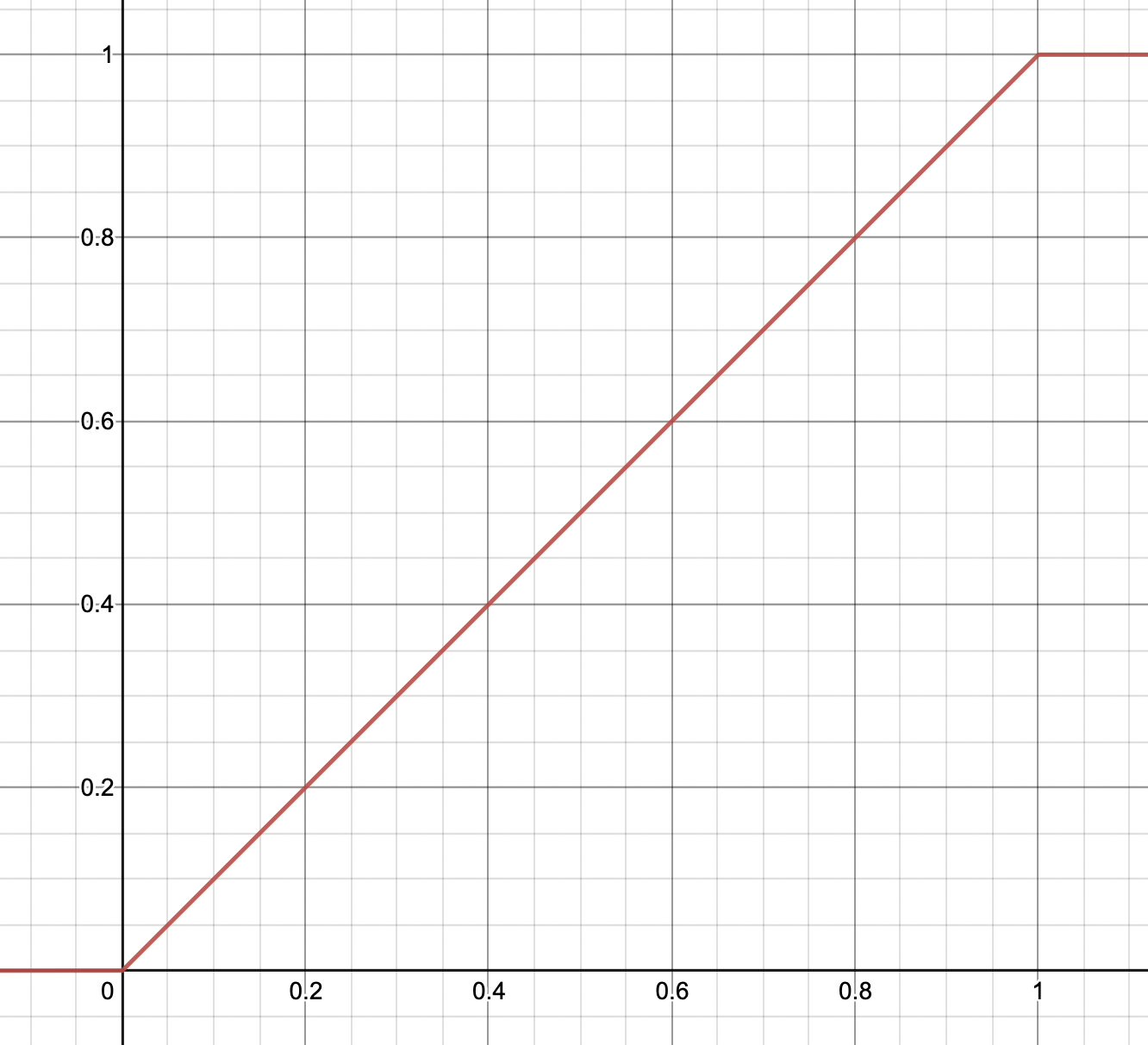

The basic approach would be a linear vesting curve. This has a start date and an end date and an initial amount. Up until the start date, the entire amount is vesting; after the end date, zero tokens are vesting; between those periods, the number decreases linearly, so after 25% of the time between start and end, 25% of the tokens have vested (are unlocked).

We believe the first 6 months are going to be pivotal for the protocol and prove the value of holding $WYND for the longer term, so we would like to vest a bit slower in the initial region. For that purpose, we plan to use a “piecewise linear” vesting curve, using the same math as Aave interest rates.

Basically the idea is we target 25% vested after 6 months. That means it increases linearly (a bit slower) for the first 6 months, and then a faster linear vesting for the next 6 months. After 25% of the time, only 12.5% will be vested, but after 75% of the time, 62.5% will have been vested.

Vesting periods

Given the market’s extreme volatility as we launch, and as we want to focus on long-term holders, dissuading people who claim and dump in a panic to cover their other losses, no airdrop tokens will be liquid until September 1, 2022. The airdrop will be closed, and the foundation will seed a sufficiently liquid pool on a Cosmos Dex.

All airdrop tokens will be subject to the same vesting rate. This is the piecewise linear curve above. The liquid tokens will range from 0 on September 1, 2022, to 25% of the airdrop claim on March 1, 2023. After that time, the WYND DAO should have established solid use-cases and market, and we speed up the vesting by a factor of 3, such that the entire airdrop claim is fully liquid by September 1, 2023.

The core team will have the same curve but be delayed by two months to ensure they cannot swamp the early liquidity. They will vest the first 25% between November 1, 2022, and May 1, 2023. And fully vest by November 1, 2023.

25% of the tokens will be initially liquid for the foundation and used to seed liquidity on a Dex. The remaining 75% will be subject to a vesting period. This will be a three-year linear vesting period, releasing 25% of their allocation each year. This ensures the foundation spreads the grant funding over more extended periods.

It is the intention that the foundation holds the tokens much longer than strictly necessary, but the vesting curve can provide some investor security on total supply.

Fairdrop to Airdrop Calculations

The Following Section describes the WYND token airdrop methodology for stakers and validators of different chains.

The WYND token will be getting airdropped to stakers and validators of various chains through a vesting contract. We analyzed data from a snapshot date of these different chains and designed the formulation of reward shares for each staker & validators engaged at various levels with the chains. Most WYND will be airdropped to many stakers on other chains, and some will be airdropped to validators.

Stakers

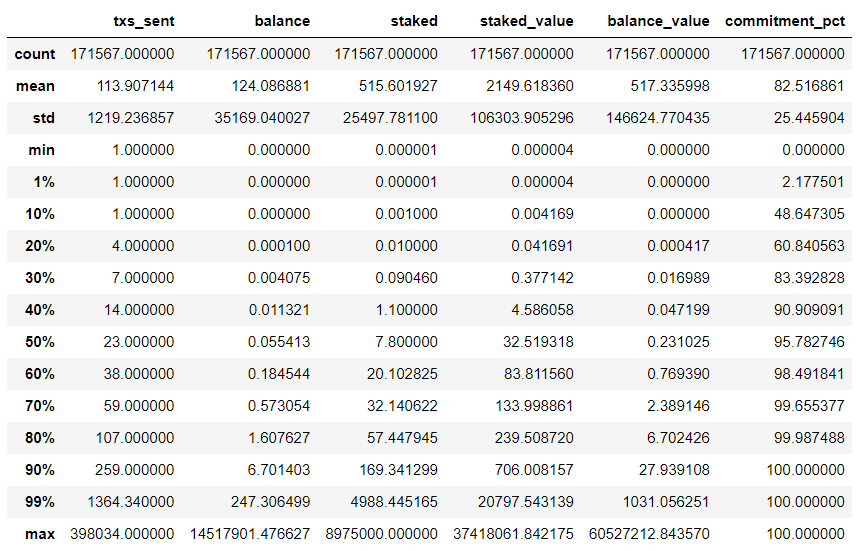

We want to reward typical stakers by not losing it for accounts with little stake amount and also don’t want to give massive amounts to whales either. We mapped out the staked amount, balance, and transactions sent for various chains and put this in a chart to analyze the distribution. You can look at this example for Osmosis:

STAKED Tokens :

We noticed that the top 1% has a HUGE amount of money. Those are real whales. Also, after we hit 70% or 80%, the ratio between columns increases significantly. The bottom 20% or 30% have 1 Osmosis or less staked on the bottom side, like dust accounts.

TRANSACTIONs :

The bottom 20% have only sent one transaction ever. Just to stake. The top 1% have sent 100s of transactions to compound their interest. If we draw a 20%-80% line, that will range from 1 tx to 14 tx ever sent, a very reasonable range.

We highly punish the ones that only sent one tx. They never voted nor withdrew any tokens. The ones with three or more are more active.

COMMITMENT :

We created an indicator for commitment level by finding the percentage of tokens staked compared to total token holdings and rewarded those with higher commitment to stake compared to the balance of the account.

Formula :

We use piecewise linear curves for all items, constant above a minimum and maximum.

Given user $X$ is percentile $\rho$ in some metric (staked,balance,transactions,commitment), we define the reward formula as :

Reward(R)= func(p, a, b, min, max)

=a ; if p < min

=b ; if p > max

=a + ((b-a) * (p-min)/(max-min)) ; otherwise

Where a,b are for percentile cutoffs over a range of points in terms of min,max.

We chose the following values for calculating individual reward points for each feature, i.e., stake points, transaction points, and commitment points, to be utilized as a multiplier for the final points calculation for a wallet.

stake points = Reward(p(staked), 20, 80, 0, 100)

tx multiplier = Reward(p(txs), 30, 90, 1, 23)

commitment multiplier = Reward(p(commit), 0, 100, 1, 3)

Total Shares = (stake points * tx multiplier * commitment multiplier)

Finally, we allocate the Percentile Rank for every wallet based on this total share score. If they get the same score, the maximum rank is assigned to each wallet.

Validators

We will also reward validators from various chains. We want to reward active validators. Not just the big guys. And we want to manually filter out centralized exchanges or other “problematic” characters. We will manually make a “deny list” of validators that are either centralized exchanges, anyone offering “0% 0r 100% fee”, or otherwise known “scammy” actors in the ecosystem. These will be removed from the validator list before making all percentiles and other calculations.

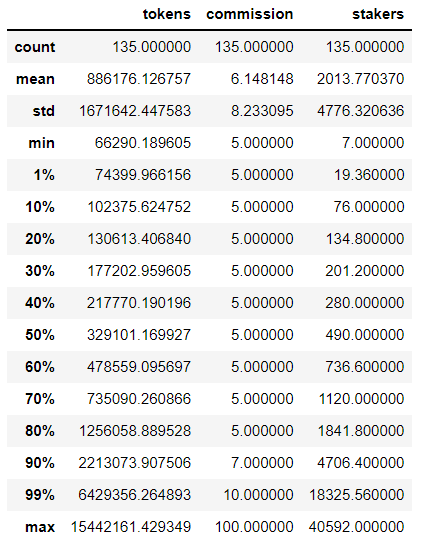

For validators’ snapshot data, we mapped token staked, commission fees, and several delegators for proceeding with our formula to allocate scores to all validators active on different chains. Validators distribution on osmosis after applying initial filters, we see the following:

Token Staked :

There is only about a 10x change between 20% and 80%. The other extremes are pretty extreme. A 10x between the most significant and most minor seems relatively fair.

Number of Delegators :

Between 20% and 80%, there is a 20x difference. I am not sure this is such a critical criterion at higher levels, but mainly to differentiate those who have relatively few and those who have a larger group. The 40% is already almost 500 delegators (while 1% is only 30). Let’s provide a multiplier over this low section and saturate at 40% (so all the rest get the same multiplier - basically a punishment for the low end)

- 0 percentile -> 20% multiplier

- 10 percentile -> 40% multiplier

- 20 percentile -> 60% multiplier

- 30 percentile -> 80% multiplier

- 40+ percentile -> 100% multiplier

Formula : Similar to the stakers formula used above, we calculated points based on total staked tokens by the validators and the number of delegators they have to be used as a multiplier for calculating the total shares.

token points = Reward(\rho(tokens), 20.0, 80.0, 10, 100)

delegators points = Reward(\rho(stakers), 0.0, 40.0, 0.2,1)

Total Shares = (token points * delegators points)

Finally, we allocate the Percentile Rank for every wallet based on this total share score. If they get the same score, the maximum rank is given to each wallet.

WYND DAO and Governance

In the initial phase, all deployments will be done by the WYND Foundation, which will also manage the contracts. This work will be handled by a five-member multisig designed to incubate the DAO until it is entirely up and running.

Shortly after the airdrop, we plan to launch a token-weighted governance contract, which will constitute the basis of the DAO. It will use a modified version of Curve’s veCRV design, such that people may bond their $WYND tokens for different lengths of time, and the longer the tokens are staked for, the more voting power they have (reflecting commitment).

Once the WYND DAO is established with significant participation, the WYND Foundation will hand over control of the WYND token contract (allowing it to mint according to the pre-defined schedule (see section 2.3). The clawed-back unclaimed airdrop tokens will also be sent to a “community pool” governed by the WYND DAO.

Initially, the WYND Foundation will retain a “veto” right on any proposal passed by the WYND DAO to ensure there are no governance attacks. This is a temporary situation of several months and is designed to prevent attacks targetting low-cap tokens. The WYND Foundation cannot pass any proposal or modify any protocol, only prevent dangerous modifications.

Once the WYND DAO is fully running, it should engage in activity beyond the scope of this white paper but aligned with the vision defined in the first section. The WYND Foundation aims to cultivate an active community forum to discuss such ideas.

Details on the exact implementation of the voting will come in a future version of the whitepaper. Still, it will be based on the DAO-DAO design, incorporating veCRV elements.

taking your WYND Tokens

Once you have collected your WYND tokens, from airdrop or purchase on an AMM, you will most likely want to stake them to participate in the WYND DAO. This is similar to staking in other DAOs or PoS chains, WYND has done a lot of innovation in this area, heavily inspired by Curve’s veCRV model.

The main difference is there is not one unbonding_period, but multiple “buckets” you can stake on. Each has a different unbonding period, voting power, and level of rewards. If you have staked LP shared on the Osmosis app, you probably got the idea… the longer you stake your LP, the more rewards.

WYND is all about long-term growth and sustainability and we wish to encourage commitment to the protocol. Especially when it comes to who is making the governance decisions to encourage longer-term planning over short term profit seeking. Thus, we have relatively large unbonding periods compared to most chains. Here are the possibilities and the relative power they have:

| Length | Voting | Rewards |

|---|---|---|

| 1 month | 1 | 2 |

| 3 month | 3 | 6 |

| 6 month | 6 | 12 |

| 1 year | 12 | 16 |

| 2 year | 24 | 20 |

Voting and rewards signify how much voting power you get per $WYND staked, or how many shares of the staking rewards you get for each $WYND staked.

You can see how both the rewards grow linearly for the first 6 months. If you want to maximize rewards with a reasonable level of liquidity, 6 months is your target. Beyond that, the rewards grow slowly, while the voting power keeps growing linearly. We only expect those truly committed to long-term growth of the protocol, with a large interest in governance participation to lock in for 1 or 2 years.

When you bond tokens, you select the bucket you wish to stake into, with the corresponding priviledges and unbonding period. You can always start unbonding your tokens in any bucket (all or part) to start the process of recovery. You will immediately get a claim with a maturity date for those tokens. Until the unbonding period has passed, those tokens remain locked in the staking contract, but don’t provide voting power or rewards. Once it has passed, you can claim them at any time, returning those tokens to your wallet.

Rebonding

We know that unbonding for 2 years, or even 6 months, with no rewards at all during that time sounds like a very scary prospect. For this reason, we have created a new innovation called “rebonding”. Like it sounds, it allows you to immediately move your tokens from one “bucket” to another without fully unbonding first.

If you originally bonded for 1 month, but then became a true believer in WYND, no fear, you can immediately move it to any bucket with a longer duration and collect these rewards. Move it to 3 months, and after you gain more confidence, just move it up to 6 months; each time enjoying the increased priviledges.

For many, the more interesting rebond is to shorter time periods. You can rebond from say 6 month to 3 months. Immediately, those tokens will provide voting and reward power equal at the 3 month levels. However, they cannot be immediately rebonded again. For the time difference between levels (in this case 6 - 3 = 3 months), they are locked at that new level and cannot be rebonded or unbonded.

This provides a nice path for gradually unstaking tokens for long-term stakers. If you put 100,000 $WYND in the 1 year bucket, but decide you want to use some of it, you can first rebond say 50,000 $WYND to 6 months. You keep earning significant rewards on those tokens for the next 6 months. After that time has passed, you can rebond those 50,000 $WYND to 3 months. 3 months later, to 1 month. And 2 month later, you can fully unbond.

This let’s you unstake longer positions, while continuing to receive rewards proportional to your commitment during the unbonding period if you plan correctly.

Note: once you start unbonding there is currently no way to change that to a rebond.

Using Vesting tokens

Most of you have your tokens locked up with a long vesting schedule. This doesn’t let you transfer it anywhere but have no fear, we provide access to the staking platform.

Vesting Tokens can be freely staked and unstaked

If you have say 1000 tokens, 900 of which are still vesting, you could immediately stake them all on the WYND DAO. Any rewards you receive are liquid assets, and let’s say you claim 75 $WYND after a few weeks.

If you decide to unbond these tokens, they are subject to the normal unbonding rules. When they are finally claimed and in your account, the same vesting rules apply. We calculate that the first tokens you stake are the vesting ones, and you only stake the liquid ones after those are all staked. This is the same way Cosmos chains handle vesting tokens with normal PoS staking.

Going back to the example, you unbond 500 of those 1000 tokens, and after 1 month passes, you can claim them. You had 100 liquid and 900 vesting earlier. 500 vesting are still locked in the WYND DAO, so we calculate you have 100 liquid (plus the 75 in rewards) plus the 400 vesting tokens.

Maximizing returns

If you want liquid tokens faster, your best bet is to stake your vesting that won’t mature in the next 6 months or so in the DAO for 6 month period. You can collect immediate liquid rewards from those tokens while they are vesting anyway.

Once they get closer to the end of their vesting cycle (and the other tokens you kept in your wallet have vested), you can start a gradual unbonding strategy as described in the staking section.

Reward Distribution

The WYND DAO Staking contract is able to efficiently distribute any $WYND tokens sent to it to all stakers, proportional to their reward shares. In the first section, we explained how you get different rewards shares per token depending on which bucket you delegate to. If you hold say 5,000 reward shares out of a total of 5,000,000, then you will receive 0.1% of all rewards paid to the contract.

We allow the flexibility to allow anyone or any contract to send rewards to the Staking Contract. For example, the WYND DAO may vote to send 1 million $WYND as an one-time payment to be distributed to all current token holders. However, the main mechanism we designed for payout is an epoch-based reward distribution, much like Osmosis LP rewards.

The distributor contract can be configured and funded by the WYND DAO. It receives some parameters on how many WYND to distribute how often. To start with, we set this to 30,000 $WYND every 1 day, or about 10 million $WYND a year. But the WYND DAO can change this in the future (raise it, lower it, or even make it hourly) with a successful vote. However, they must then ensure they direct a sufficient amount of the inflation to the distribution contract to cover these rewards.

The distribution contract cannot mint WYND, it can only drip out $WYND previously sent to it on a well-defined schedule.

Example returns

For now, we will focus on the initial conditions of WYND DAO, although these may change in the future based on successful proposals from the WYND DAO. Those are a total of 30,000 $WYND split over all stakers, regardless of the total amount staked.

You can quickly see that the lower the total staked is, the higher the APR is for every staker, making this extremely profitable the first few days (and benefiting the most active WYND members). Let’s examine some scenarios.

Early stage:

Others have staked 100,000 $WYND for 3 months, providing a total of 100,000 * 6 = 600,000 reward shares

You stake 500 $WYND for 1 year, giving you 500 * 16 = 8,000 shares.

After one day, you will receive (30,000 * 8,000 / 600,000) = 400 $WYND in one day!

Now, such crazy rewards will only be the case when few have invested.

Mid stage:

Many airdrop holders have staked.

Now something like 10,000,000 $WYND for 3 month and another 10,000,000 $WYND for 6 months.

That would be 10,000,000 * 6 + 10,000,000 * 12 = 180,000,000 reward shares.

You have reinvested your earnings from the early days and now have 2000 $WYND at 1 year = 32,000 shares.

Each day, you would receive (30,000 * 32,000 / 180,000,000) = 5,33 $WYND

This is still 5,33 * 365 = 1946 $WYND a year or almost 100% APR, assuming only 20% of total WYND is staked.

Calculating APR

The APR depends on the total amount distribute, the total number of stakers and the total reward shares you have. All numbers can be queried from the blockchain.

When you decide to stake in a bucket with a reward multiplier M, given a total rewards shares of T (likely 6 - 15 times total staked WYND), we have an APR of:

APR = 365 * 30000 * M / T

In the mid stage example above, T is 180,000,000, and we would have the following APRs for the various unbonding periods:

| Length | Reward Multiplier | APR |

|---|---|---|

| 1 month | 2 | 12.1% |

| 3 month | 6 | 36.5% |

| 6 month | 12 | 73% |

| 1 year | 16 | 97.3% |

| 2 year | 20 | 121.6% |

As more people keep staking, these APRs will go down. And the WYND DAO can vote to direct more of the inflation rewards to the distribution contract to increase them if they deem it the most effective use of funds. (Or they can use them for LP rewards, investing in other protocols, funding development and marketing, etc).

Now you have a good overview of the staking rewards, and how beneficial it is to stake early on, read more about stakers can participate in the voting process itself.

The voting power is calculated via the amount staked and the voting multipliers defined earlier.

The voting process of making proposals and voting is the same as the standard DAO DAO process

The only difference is that after successfully passing a proposal, the WYND DAO cannot immediately execute it, but rather the WYND Foundation must execute the proposal. This is like the President of the US signing laws to make them official, and effectively gives the WYND Foundation veto power over the decisions of WYND DAO. (Note it cannot take any actions without the approval of WYND DAO, just block actions)

This is only designed for the bootstrapping phase, and once the WYND DAO is well established and has constructive governance, the WYND Foundation will remove the veto right, granting the DAO full power to execute anything it sees fit. This is mostly designed to prevent potential governance attacks early in the life of the protocol when many people haven’t yet staked and the token value is not well established.

WYND’s ReFi Vision

For governance to achieve its full potential, the community participating in governance needs to have a shared vision of where they want to go. Without a shared vision, they will bicker over everything, and there is no shared direction. If the shared vision is limited like “maximizing token holder value”, progress can be made in that one domain, but the community would be hard pressed to answer questions with deeper ramifications, even selecting the proper validator set for a staking derivative (which criteria do we use to select? lowest commission? active community member? not a top validator?).

We wish to create more holistic and deep-reaching governance for WYND DAO. To that end, we propose the following long-term vision for WYND DAO as a whole:

The WYND DAO will leverage blockchain protocols to protect and regenerate the world’s ecosystems.

There are many milestones and intermediate goals on the way to this. WYND DAO must be a profitable and sustainable DeFi protocol in order to continue existing and to control economic value which can help with ecosystem restoration. We need to build community, spread the word, launch various protocols, etc. But the long term vision is like a compass to keep us focused on a shared goal, and hold us together as a community, so we don’t get lost while focusing on the next steps.

State of the planet

As we enter 2022, every living soul on this planet can see and feel the drastic changes happening around the globe. Humans are the most intelligent species and hence can observe, calculate and deduce the cause-effects on a larger scale. Irrespective of education, degree, and skills, every human on this globe can see the damage to the environment, the deterioration in climate conditions, and the increasingly extreme weather conditions. We have large-scale fires, frequent storms, and disruption to agriculture.

(src)

We strongly believe that the current sad and grim state can be changed and transformed into a harmonious state. However, we can’t do this until we awaken and are compassionate towards nature and all its creatures and align our actions with our beliefs. Unfortunately, most people who awaken to the need to reverse the damage to our planet are left feeling helpless.

We realize that we can’t rely upon a few people sitting in governments to take actions to bring a sustainable ecology to this planet; that all current economies are fundamentally based on increasing exploitation of “natural resources,”; and that “lifestyle changes” like eating organic or donating to the WWF are far too small to turn the tide. Yet, what can we do?

Bringing forth a genuinely sustainable future requires everyone, or at least a large majority of people, to be involved in the process. There have only been two successful approaches to a large-scale organization: hierarchical systems like governments and large corporations and competitive games that exhibit emergent behavior, like market economies. Horizontal organizations, like coops, often show increased efficiency and democratic participation in the areas they have been applied to but have worked well only at relatively small scales.

Why WYND is revolutionary

WYND sees the potential of blockchain technologies to engender new forms of large-scale collaboration toward positive, life-affirming futures. Cryptoeconomics and mechanism design allows projects to create new competitive games with different emergent behavior than market economies. DAOs are in their infancy but have already shown great potential enabling large groups with a common purpose to form and take collective action quickly.

WYND uses technology to bring awareness and visibility to all humans about their surrounding environment and put a proper value on it. We provide a platform to make them active contributors, not just limited to the scope of WYND or any one organization, but in the immense size of life itself. We seek to achieve harmony between nature and technology while rewarding everyone who has put their skin in the game in any form under this belief system.

WYND views itself as part of the ReFi movement and aligns with the general vision of the Green Pill Party. We also build upon years of experience in real-world, offline collectives and horizontal governance. Some of us have been working on mechanisms to go beyond coin voting governance for years, both in theory and in implementation. And take inspiration from decades of ideas, best summarized in Buckminster Fuller’s World Game:

“Make the world work, for 100% of humanity, in the shortest possible time, through spontaneous cooperation, without ecological offense or the disadvantage of anyone”

WYND strongly believes and is committed to building a better, healthy world with the current technology, web-native/scale, and building infrastructure, tools, and services around that to support and enhance the entire ecosystem. This enables everyone to have some learning and role in contributing to a better world rather than just limiting it to an individual’s benefit.

WYND Environmental Data & Oracles Service

WYND is committed to bringing visibility to the environmental conditions by bringing the correct data to measure the current state appropriately. To achieve this, WYND is actively building data services for fetching orbital (satellites) as well ground-based data from communities, organizations, and volunteers.

There is now a critical need for an intelligent data system integrated with a marketplace economy to leverage the vast potential of these data sets fully. Satellite observations need ground data for validation and calibration. Ground measurements on forest fires, land cover changes, and air pollution are critical to building a bridge between the global picture painted by the satellites and the contextual reality of what happens on the ground. Data collected from different sources are sometimes challenging to locate and understand across diverse formats. Published scientific analyses can be complex to reproduce for new use cases and are sometimes not easily comparable with other metrics and algorithms. Many scientific data products do not follow common data protocols or even have a clean API to query for another task. Finally, and perhaps most importantly, the collaborative sharing of data and algorithms often stalls due to the challenge of incentivizing and rewarding continued interest and community development. The inconsistency of funding often precipitates the breakdown of relationships between data users and providers due to funding constraints, which eventually renders data sets obsolete to operational management decisions and environmental action.

WYND data services are founded on the following tenants:

- simple trusted data

- reproducibility

- interoperability

- free exchange

- easy collaboration

This approach provides a foundation that will enable a multitude of conservation and business applications focused on ecological health, as well as turbo-charging research and analysis to advance the state of the art.

Open Data

One essential aspect of this project is that all source data is open. This ensures we don’t end up like another Microsoft Earth, a pay-to-play initiative that many cannot access and one organization controls. We are establishing a data commons and providing value-added services on top of it. The original datasets we are working with are often under some open license. Generally, that would be Public Domain, CC0, CC-BY (attribution required), or even CC-BY-SA (share derivative work must also be open).

This means that the original data (in an increasingly normalized format) will be available to all. The indexes to search and organize such data will also be fully open, and the various algorithms we use to process the data.

However, many projects uploading “ground truth” need continuous funding to be sustainable. While we require all remote sensing data to be under an open license, we will allow such user-uploaded data to be a non-open-source, as many groups are concerned about reuse without payments.

To provide a viable revenue stream for all data providers, we focus on value-added products on top of the data. Other teams can build products directly on the primary data for free or pay to use these extensions.

Data Value Enrichment

WYND will collect user-specific data and other open data sources and perform the process of Extracting, Transforming, and Loading data on the base map based on the base map’s location index (H3 Index). Once this user-specific data is enriched utilizing all other data sources, some extra model weights may be applied by federated machine learning and deep learning models for more user-published data enrichment. This new fused dataset will then calculate certain quality indexes to represent a shareable user and site behavior that changes over time. This brings unprecedented visibility to the site and the data publishers to the whole community.

Together the WYND aims to present a framework that serves as a market for innovation and which will evolve as observing techniques and algorithms advance. Still, innovation will be contained within three basic categories for descriptors and metrics of ecosystem health:

Carbon / Living Biomass:

These metrics describe the total mass of living organisms in an area or region, and can be associated with carbon stored in living plants.

Biodiversity:

These metrics represent the characterization of the breadth of the varied species within a region or ecosystem, including plant, animal, fungal, and microbial classifications.

Degree of human intrusion:

These metrics represent objective measures of human presence and landscape alteration, and include variables such as mining, logging, agricultural density and type, road density, human population density and nighttime lights.

Pollution:

These metrics describe the degree of toxicity (i.e. the ability to cause harmful effects over long periods), of the air, water, or soil, often associated with foreign chemical contamination.

These metric classifications were designed for their comprehensiveness as well as for their orthogonality. They are comprehensive in that these metrics will conclusively describe the health of a region or ecosystem. They are orthogonal in that any one of these metrics may change in isolation from the others. For instance, while it is likely that many of these metrics would be consistent or correlated for an impacted region (e.g., the city of Los Angeles), environmental action may shift only one (e.g., with a conversion to electric vehicles, the pollution metric alone may improve). As we consider a rapidly changing ecosystem, it is likely that these metrics could evolve independently or in sequence but may not be temporally or spatially correlated.