Cosmos Hot Takes for 2023 - By Imperator

Five predictions about the Cosmos ecosystem for this year by Imperator Research.

Disclaimer - This is part of our outside perspective series. Curious Cosmonaut Research is not the author we are simply highlighting some good threads and perspectives on the Cosmos ecosystem with their permission. We also, therefore, do not guarantee their accuracy.

Author: Imperator Team

Source: Blog

Date: February 1, 2023

Cosmos is a highly innovative ecosystem in the cryptocurrency space, with multiple teams addressing diverse challenges, all built on the same underlying technology. This contributes to its viability and constant improvement, making it one of the best technologies ever developed.

Cosmos has become a playground for developers and teams to experiment with the technology, build new features, and see the potential end result. Based on what I have seen in the space, here are five predictions for Cosmos in 2023.

1. Interchain Security won’t have the expected success

Interchain Security and its upcoming first version, called Replicated Security, will be the very first shared security solution on Cosmos. The concept is simple: one chain, referred to as a Provider chain, provides its economic security to other chains, referred to as the Consumer chains.

There are numerous advantages to this, the first one being that the Consumer chain inherits the security of the Provider chain, making it equally secure. As a result, a Consumer chain using Replicated Security with the Cosmos Hub, benefits from an economic security of over $2 billion right from the start. Another benefit of that model is that the Consumer chain does not have to bootstrap its own set of validators set, as the validator set of the Provider Chain will directly produce blocks for the Consumer chain.

In return for this, it is expected that Consumer Chains will compensate ATOM stakers and validators. This model may appear attractive at first, but there are several points that could prevent it from being as successful as it appears to be. Let’s analyze this further.

- Scalability issues

In its current form, Interchain Security is not scalable due to the necessity for validators to run a new node for each new consumer chain. This results in an expensive and resource-intensive infrastructure to maintain for validators.

It is unthinkable to imagine 1,000 Consumer Chains using Replicated Security due to the heavy infrastructure it would require for validators. If there is an ambition to reach this goal, a lighter solution for validators must be found.

- Compensations

As a validator, the hardware setup to run an ICS chain with Replicated Security is exactly the same as for the Cosmos Hub. Therefore, the cost is linearly related to the number of chains added; this means that adding just one ICS chain will double the infrastructure cost for the validator. Does it double the income though? The answer is no.

Each project that wants to use Replicated Security must go through governance and be accepted as a Consumer Chain by the validators and stakers. Therefore, they will closely monitor the compensation the project is offering, as it is reasonable to expect remuneration for the benefits Replicated Security provides. If the project is not providing adequate compensation to validators and stakers, or none at all, it is unlikely that they will be accepted by governance, unless they offer something highly strategic to the Cosmos Hub.

- Sovereignty

Under replicated security, the Consumer chain is not sovereign in block production as it is completely dependent on the validator set of the Provider Chain. Therefore, Consumer chains are basically transferring value to another blockchain.

Not having control over its block space will become an issue for the most successful Consumer chains, especially those that will generate a great amount of MEV activities. Therefore, it is likely that the most successful consumer chains will not remain as Consumer chains to have full control over their blockspace. Because why would you bring value to the stakers and validators of another chain, when you can bring this value to stakers and validators of your own chain if you become a sovereign Appchain?

I view Interchain Security as an Incubator, providing projects with security and without the need to worry about a validator set, allowing them to grow and become a sovereign Appchain for the most successful ones. If this were to happen, we may wonder what the future of Interchain Security would be if all successful Consumer chains were to leave.

Of course, that does not apply to projects that that prioritize security over everything else. For example, the upcoming generic purpose issuance chain is expected to issue native USDC, so using Interchain Security makes sense as native stablecoins are crucial for the ecosystem. Similarly, a liquid staking chain should prioritize security and Interchain security is a good long-term option, given that the Cosmos Hub has the largest economic security within the Cosmos.

There are still points to be addressed to make Interchain Security successful, and scalability should be the primary focus. Alternative versions to Replicated Security exist; the opt-in version has an issue with the subset problem, and ICS v3 appears to be less attractive than Mesh Security.

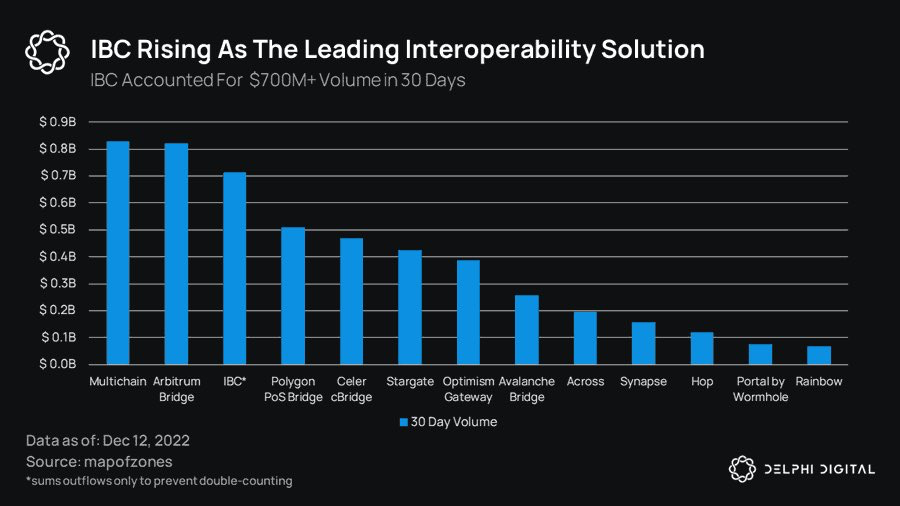

2. IBC is set to become the most dominant bridge in crypto

IBC (Inter-blockchain Communication protocol) plays a crucial role in the Cosmos ecosystem. The success of the Appchain vision relies on the ability of different blockchains to communicate with one another. This is why IBC is one of the most popular bridging solutions available.

IBC is more than just a bridge: it is a general-purpose message passing protocol that facilitates various forms of data communication across IBC-connected chains.

My take here is that IBC is likely to become the dominant bridging solution in the crypto space by 2023 for several reasons:

- The launch new IBC-enabled blockchains (dYdX Chain, Sei Network, Nibiru, Quasar …) will increase the number of IBC transactions.

- Wormhole's upcoming Wormchain will be IBC-enabled, and connect Cosmos with +20 other ecosystems, thereby increasing IBC volume.

- Teams such as Composable or Electron Labs are working on extending IBC to other ecosystems, such as connecting the Polkadot and Ethereum to Cosmos using IBC.

- With the upcoming new modular blockchains coming to Cosmos and the emergence of rollups, there will be a necessity for rollups to communicate, and using a protocol such as IBC could be a way to ease communication between them.

- Lastly, the development of more complex features, such as cross-chain swaps, cross-chain lending markets, and cross-chain arbitrage opportunities, is also expected to lead to an increase in IBC volume.

IBC offers several advantages that make it more secure than other solutions. First of all, it is permissionless, allowing anyone to act as a relayer between blockchains A and B. Additionally, there is no need to trust a third party in IBC, as it’s secured by validator sets. Furthermore, IBC is general, it’s not only for Cosmos and can be applied to other ecosystems.

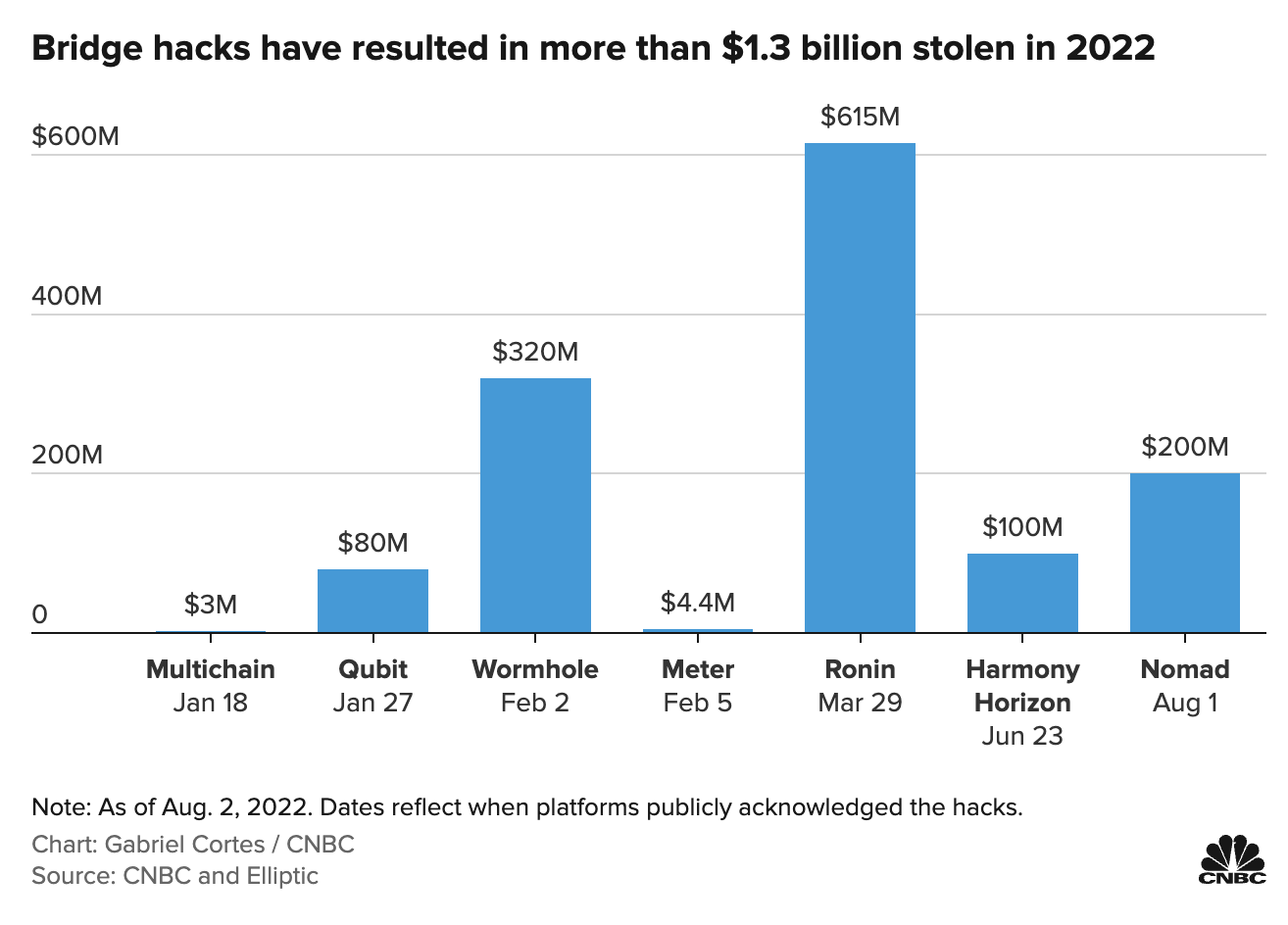

In a sector as important as bridges, which is also one of the most hacked sectors in crypto, security is a critical concern and the ability to rely on bridges that can be trusted is highly important.

IBC is currently one of the most battle-tested and secure bridges available, with a proven track record of reliability. While there are still risks associated with its use, a bridge that relies on entire validator sets is more secure than one relying on a simple multisig.

3. Celestia will be a new paradigm in the crypto world

Celestia is the missing piece in the Cosmos ecosystem.

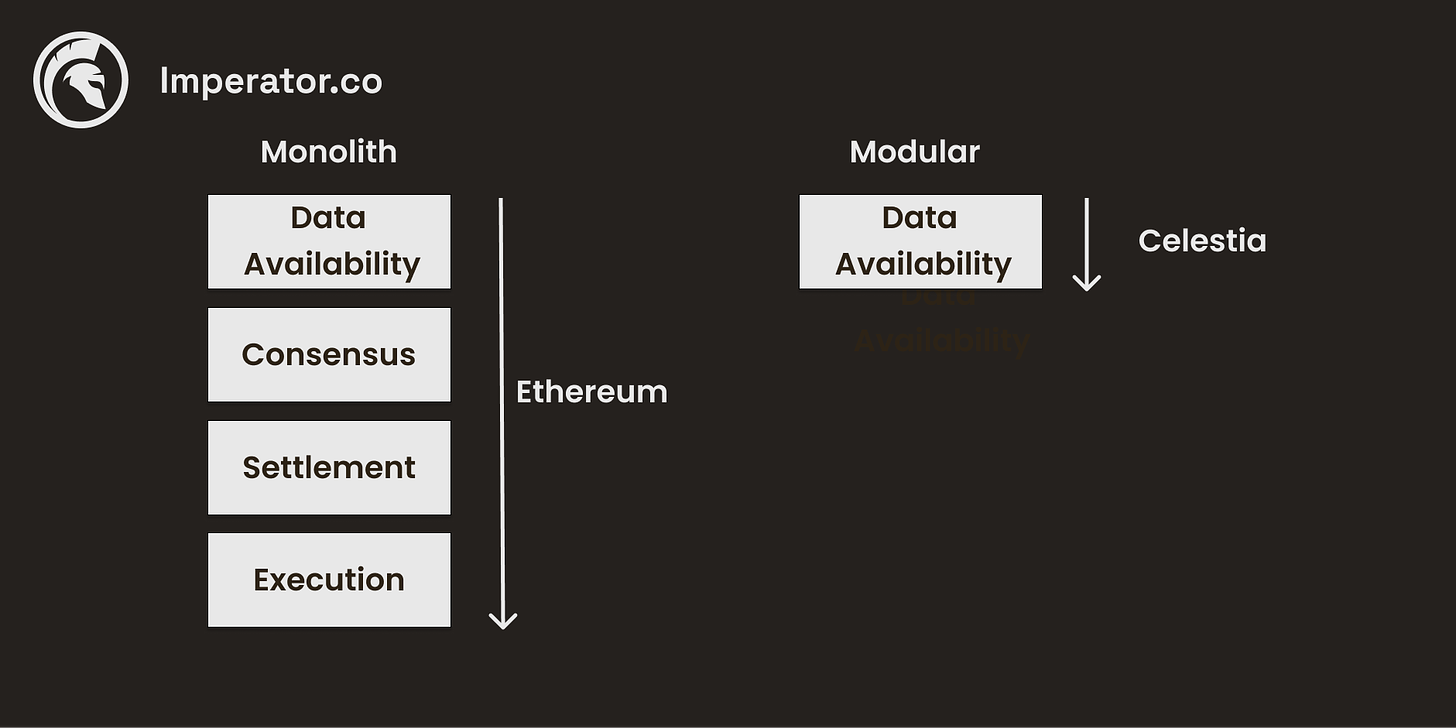

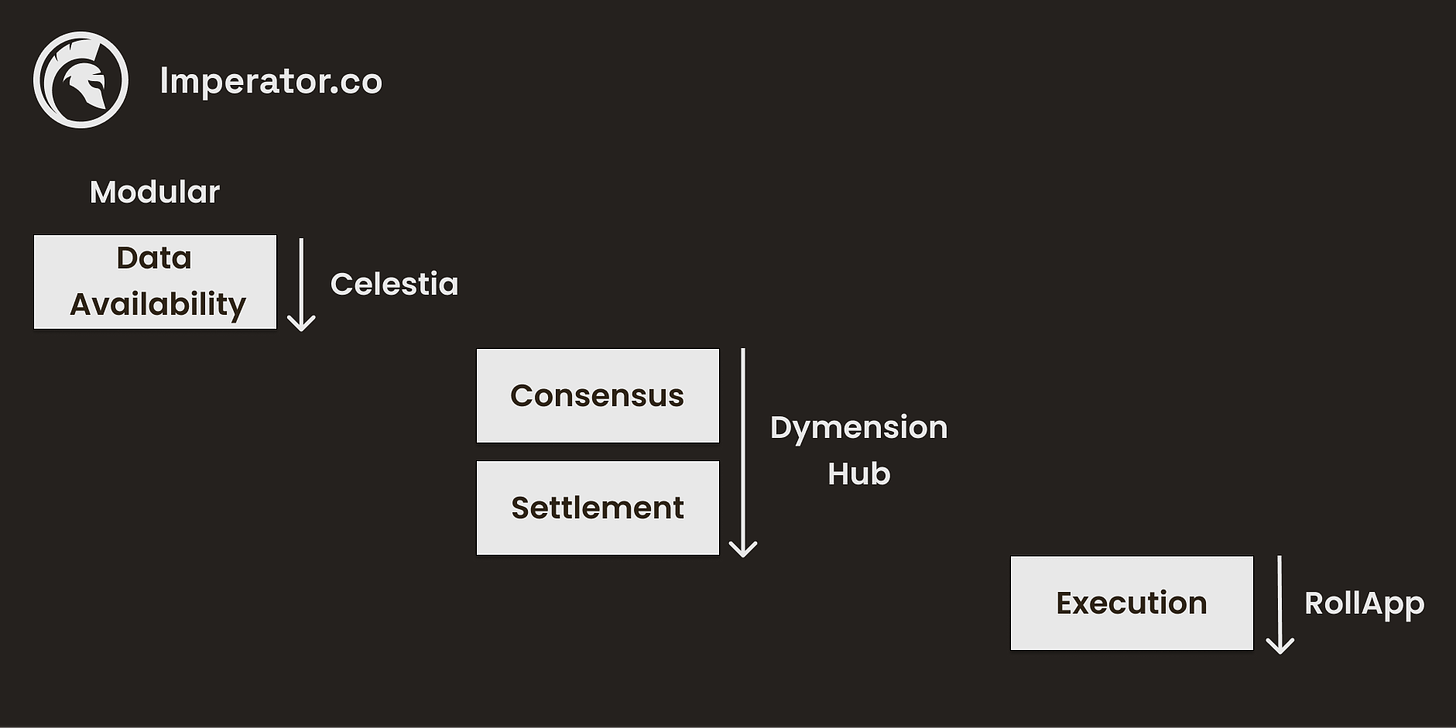

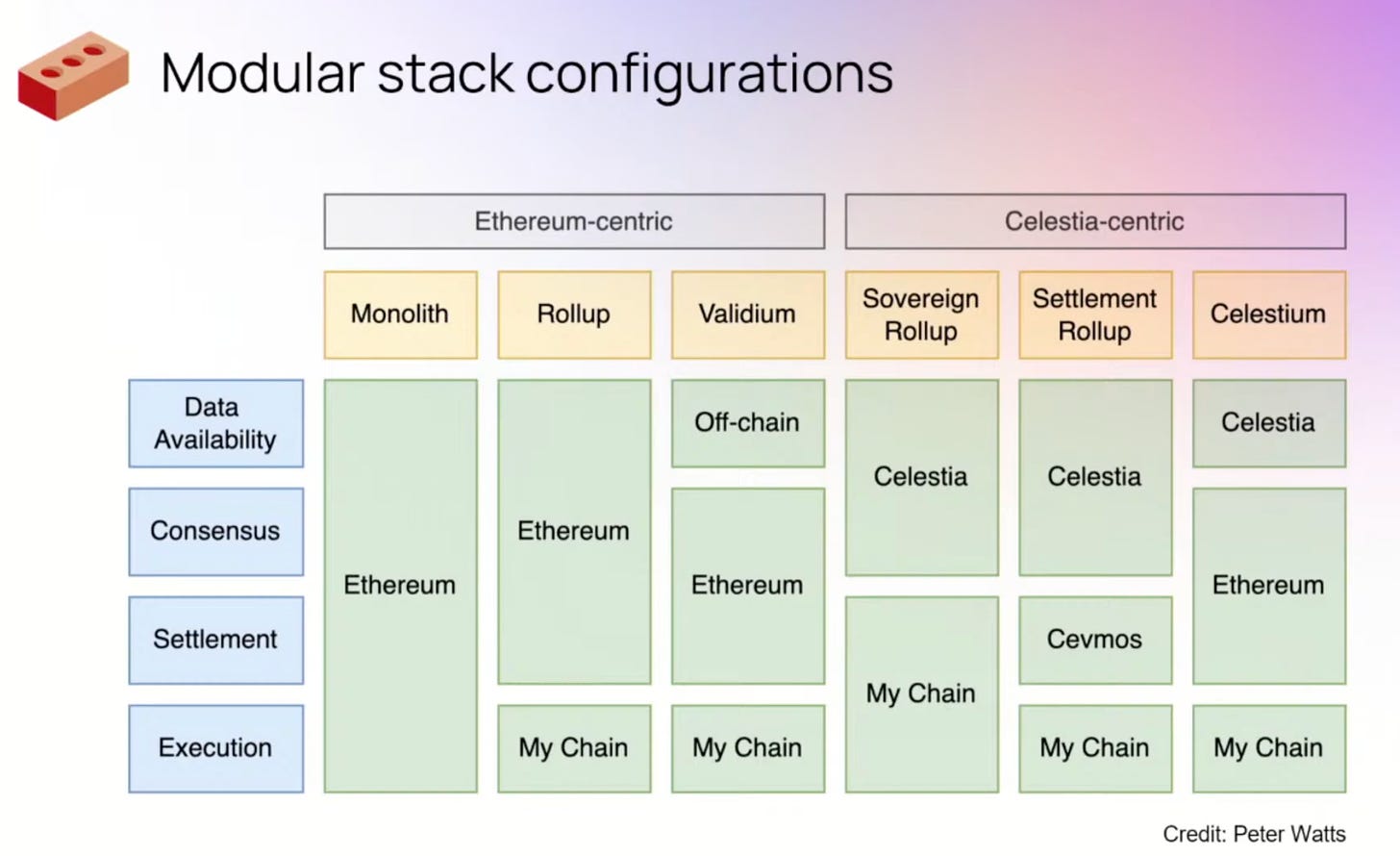

Celestia is a modular blockchain, which is a blockchain that outsources at least one of these four components: data availability, consensus, settlement, and execution, to an external chain in order to improve performance, efficiency, and scalability. This is in contrast to traditional monolithic blockchains such as Ethereum, which handle all four components in the blockchain stack.

Modular blockchains like Celestia are more scalable because there is a separation of resources, meaning that each node is more specialized to a specific function, resulting to more efficiency.

Celestia is responsible for Data Availability, which guarantees that data is organized and accessible to users and applications. This is critical, as without it, users and applications would be not be aware of the current state of the chain. Celestia utilizes an efficient technique known as Data Availability Sampling, which uses light nodes to verify %n by many. For a comprehensive article about the Modular World, I suggest the one from Rain & Coffee.

Any project can use Celestia as a data availability layer and focus on the other parts of the blockchain stack. We may come to a world in which Ethereum could use Celestia as a data availability layer.

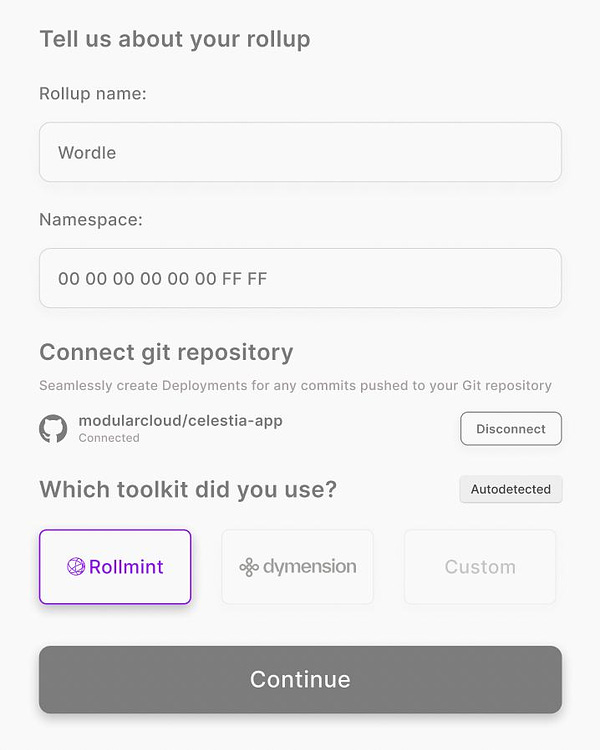

I anticipate that many projects will adopt Celestia as a data availability layer and construct their own sovereign rollups on top of the chain. To facilitate scaling, it is crucial to simplify the deployment process for developers, and a one-click rollup kit already appears to be in development:

lzrs @lzrscgcoming soon: 1-click rollup deployments

245Likes34Retweets

The utility of the Celestia token will increase as more rollups are implemented on top of the chain, as rollups will have to pay for the block space to post data on the Celestia chain. This interaction can be abstracted away from the end user and people using the rollup won't need to hold Celestia tokens to pay for fees; that is entirely up to the sovereign rollup to decide what the fee tokens should be. But, in order for the rollup to pay in Celestia for block space, we could imagine some solutions such as the use of an AMM that swaps the rollup native token into Celestia tokens automatically to pay the Celestia chain for instance.

Additionally, Celestia is a great scaling and security sharing system.

Rollups inherit the security of Celestia from the beginning. The infrastructure cost is also much lower compared to other solutions such as Interchain Security; and it will be interesting to observe the competition between the two, as Celestia offers almost the same advantages as Interchain Security without the same trade-offs.

One area that will be highly important for Celestia is interoperability between different sovereign rollups. As of now, it is up to each rollup to decide which bridging solution to use, and if each of them selects a different solution, it could lead to a poor user experience.

Celestia is one of the most exciting projects of 2023.

4. Appchains are NOT suitable for everyone.

If there is one lesson we should take away from the last two years, it is that the Appchain thesis is not the best solution for brand new teams. An Appchain is not easy to manage, as the core team must not only focus on its core product, but also on the infrastructure and security of the chain. This is a difficult task.

The greatest challenge for the teams was how to make the blockchain economically sustainable in order to cover the infrastructure costs of validators and incentivize people to stake to secure the chain. The bear market has demonstrated that many small-cap projects have been unsuccessful in that regard. In 2023, if the bear market persists, we will see many validators leaving chains that were once promising Appchains but have since become zombie-chains.

Alternatively, the new teams will be more attracted to the new features and solutions such as Celestia, Interchain Security, or SAGA than building their own Appchain, allowing them to focus on their product first, attract users and liquidity, and, once successful, building an Appchain if there is a need to it.

DYdX is a great example. It initially began on Ethereum, then moved to Layer 2 (StarkWare), and now they have a great working product that is attracting liquidity and users, they decided to launch the dYdX Chain due to the specific features they desired, such as flexibility, sovereignty, and decentralization.

It makes more sense for a successful Decentralized Application to build its own Appchain than for a new project to start a chain from scratch. I would not be surprised to see another important DeFi protocol decide to build a Cosmos Chain, the pieces we are still missing are an oracle such as Chainlink on the ecosystem, as well as IBC connected to Ethereum.

The Appchain thesis still holds, but for new teams in the space, I would recommend starting with an easier solution than building a chain, so they can focus on the product first. If successful, they can then build their own chain.

5. The lack of composability on Cosmos is slowing down adoption

It is difficult for teams to build on Cosmos compared to ecosystems such as Ethereum, where deploying smart contracts is relatively straightforward.

The sovereign nature of Appchains on Cosmos impedes composability, which in turn slows global adoption. For example, here are some tasks that are simple to implement on Ethereum and difficult to do on Cosmos:

- Developing a DEX Aggregator

- Developing a Yield Aggregator

- Developing a Borrowing / Lending product

- Doing Flash Loans

All of this is hard to do on Cosmos because it needs to deal with different chains, and this requires having IBC transactions between all the different steps. We just have to see how hard it was for Mars Protocol to build its Hub and spoke model.

Therefore, in 2023 I anticipate more teams working on those issues to build tools and products to solve those points, but at the expense of a slower adoption of the Cosmos Ecosystem.