Aura Network Whitepaper/Originating Documentation

The Aura team whitepaper covers their blockchain to accelerate NFT adoption to the mainstream.

This whitepaper/originating information accuracy is in no way endorsed by Curious Cosmonaut Research. This paper’s content was aggregated from their website here on 1/27/2023 as part of a series to make content more accessible from one place in Cosmos.

About Aura Network

Aura Network is an ecosystem built to accelerate global NFTs adoption for mainstream users. Our vision is to create a one-stop destination for building NFT projects that has real utility and gradually help transforming existing web2 businesses to web3.

- Aura Network Foundation works directly with brands & IP owners to bring their web2 portfolios to web3.

- Focus on better user experience

- Pushing forward NFT adoption on real life use cases.

- Providing web3 developers open-source, scalable tools to accelerate software development.

- Aura Network is built using Cosmos SDK, the world's most used framework for building blockchains.

To learn more about the vision and growth strategy of Aura Network, please take a look at our Whitepaper

Aura Ecosystem

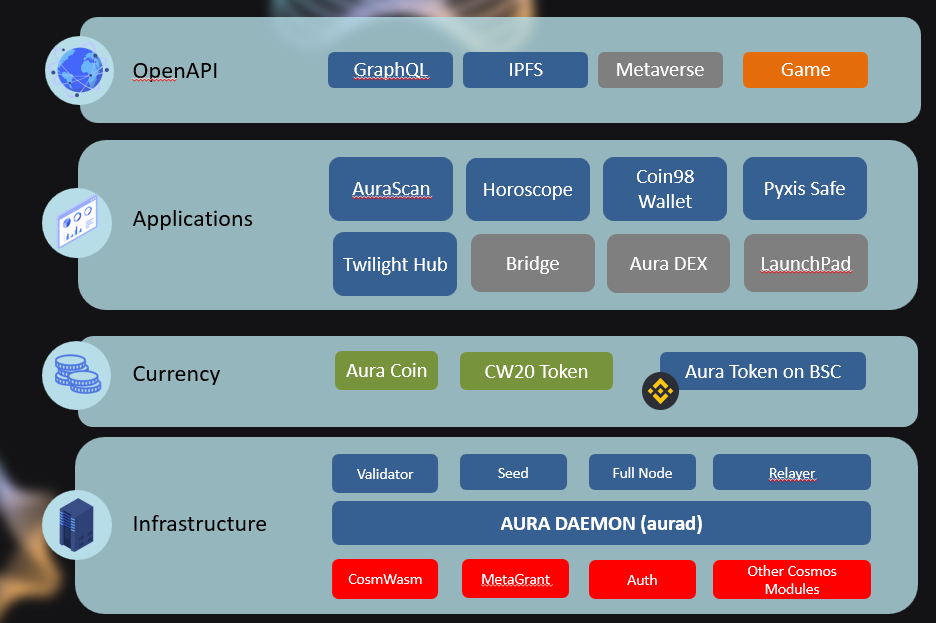

The Aura ecosystem can be divided into 4 layers

- 🖥 Infrastructure: contains all resources relating to the underlying blockchain platform. This includes the node client Aurad and all resources such as genesis block, configuration files and deployed services serving the Aura Network blockchain.

- 💰 Currency: There are 2 native currencies of the Aura ecosystem: Aura Coin and Aura Token on BNB Smart Chain. Aura also supports creating CW20 tokens, similar to other blockchains that use CosmWasm module.

🅰 Applications: applications that offer rich user experience in working with DeFi and NFT. The list is continuously growing, but we have several things in development at the moment (The highlighted ones are what we are working on, gray ones are reserved for future development/collaboration):

- Aurascan: The blockchain explorer with extra features for governing, staking, NFT, notifications, etc. that are tailored towards Aura holders.

- Pyxis Safe: Gnosis-safe inspired multi-signature wallet.

- Wallet: Aura official wallet is Coin98 Wallet. Other Cosmos supported wallet such as Keplr, Cosmostation are also supported.

- Twilight Hub: one-stop destination for Aura community to interact with NFT and metaverse.

- Aura DEX: decentralized exchange for CW-20 tokens building on Aura.

- Bridge: aura bridge for swapping assets between EVM-based blockchain and Aurachain.

- Launchpad: Aura provides intensive supports both in terms of technology and funding, business promotion to NFT projects building on Aura chain.

- 📑 API: applications building on Aura are required to provide standard open APIs for public serve.

Resources

A list of all Aura Network resources is at: https://lnk.bio/auranetwork

Aura Network Tokenomics

1. Token types

There are 2 types of native tokens in the Aura Network: the BEP-20 Aura Token on BSC and Aura native coin on Aura mainnet.

- BEP-20 Aura is an IOU token on BSC. It is currently deployed at 0x23c5D1164662758b3799103Effe19cC064d897D6. BEP-20 token holders later can swap to native $Aura coin after launching mainnet Like other BEP-20 tokens, Aura Token can be freely traded through popular DEXs and CEXs. Aura Token also helps provide liquidity on BEP-20 compatible exchanges and bootstrap users from this community.

Aura Coin is the native currency of the Aura Network chain. Besides the trading capability of BEP-20 Aura Token, Aura Coin has many other utilities:

- Staking: Aura Coin holders can delegate their coins to trusted validators to earn passive commission income from the network.

- Governing: Aura Coin holders can participate in voting for software updates or other important decisions on how the Aura community should be developed.

- Transaction fee: Aura Coin is used to pay for transaction fee.

- Exchange and Swap: Aura Coin can be exchanged or swapped in the market.

2. Token distribution

Aura max supply is capped at 1 billion tokens. Token allications and vesting schedule are defined in the following table.

| Token Allocation | Allocation (%) | $AURA | TGE | Vesting Schedule |

|---|---|---|---|---|

| Ecosystem Growth (ignore in circulating supply) | 21.25% | 212,500,000 | 30.00% | TGE 30%, linear vesting over 2 years |

| Ecosystem Growth - Token Listing | 1.75% | 17,500,000 | 100.00% | TGE 100% |

| Strategic | 13.00% | 130,000,000 | 0.00% | TGE 0%, linear vesting over 2 years |

| Private Sales round 1 | 2.16% | 21,600,000 | 2.00% | TGE 2%, linear vesting over 2 years |

| Private Sales round 2 | 0.60% | 5,957,500 | 5.00% | TGE 5%, linear vesting over 2 years |

| Foundation Reserves (ignore in circulating supply) | 14.99% | 149,904,038 | 0.00% | linear vesting over 2 years |

| Public Distribution on IF Launchpad | 1.25% | 12,538,462 | 100.00% | TGE 100% |

| Block Rewards | 25.00% | 250,000,000 | 0.00% | Over 5 years |

| Team and Advisors | 20.00% | 200,000,000 | 0.00% | TGE 0%, 1 year cliff then linear vesting over 3 years |

| Total | 100.00% | 1,000,000,000 |

3. Circulating Supply

There are 2 funds that are controlled by the Aura Foundation:

- Ecosystem Growth: This fund is used for ecosystem development such as project grants, bug bounties, attracting stakeholders to provide utility services, etc.

- Foundation Reserves: It is supposed to be served as a “last-resort” in the case that the network requires funds to solve a particular problem that another source of funding (e.g Community Pool) is not on the table.

These funds are excluded from the Aura Token circulating supply. There are several reason for this.

- They cannot be staked to earn passive income rewards or governing influence.

- Their existent should not cause any impact on network bonding rate.

- If Aura Foundation wants to use these tokens for any purpose, they must be moved out to an intermediate account then accounted in the network circulating supply.

On BSC, both of these funds are controlled by a multisig address: 0x43b57228bf23a1695c81100c5d01b0283e239228

4. Block Rewards

25 percent of the total coins will be periodically minted as block rewards to distribute to validators and delegators. Incentives play a big role in deciding the token allocation. For example, allocating “insufficient” amount of tokens to validators may lead to the extreme case where validators cheat the network by accepting fraudulent blocks (e.g doublespending), or validators may not be interested in participating the network which threats the network security. Allocating too little tokens to advisors may result in advisors being “inactive”, discouraging them from engaging with the team to provide helpful advice.

In the first 5 years of Mainnet, a total of 250 million Aura Coins will be distributed for delegators in every block. Apart from the block rewards from the network, validators also receive transaction fees (gas) from transaction creators. We assume that after 5 years of running Aura Network, the transaction fee from the network will be large enough to reward validators so there will be no need for block rewards to be minted anymore.